Big-Ticket Commercial Properties Changes Hands in Q2 2020, While Overall Market Activity Was Muted.

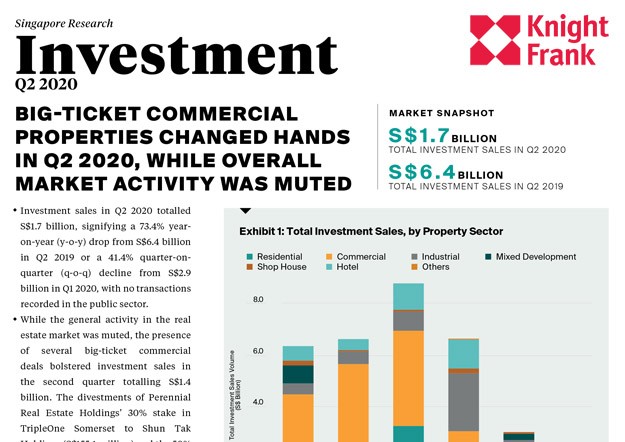

Investment sales in Q2 2020 totalled S$1.7 billion, signifying a 73.4% year-on- year (y-o-y) drop from S$6.4 billion in Q2 2019 or a 41.4% quarter-on-quarter (q-o-q) decline from S$2.9 billion in Q1 2020, with no transactions recorded in the public sector.

While the general activity in the real estate market was muted, the presence of several big-ticket commercial deals bolstered investment sales in the second quarter totalling S$1.4billion. The divestments of Perennial Real Estate Holdings’ 30% stake in TripleOne Somerset to Shun Tak Holdings (S$155.1 million) and the 50% stake in AXA Tower to Alibaba Group's Singapore subsidiary (S$840.0 million) formed a substantial proportion of the deals inked. More recently, Oxley Holding and Oxley Beryl, owners of the former Chevron House, are in the midst of selling the retail and commercial units of the development to Siriti R Pte Ltd and Siriti C Pte Ltd for S$315.0 million.