Office Market Update

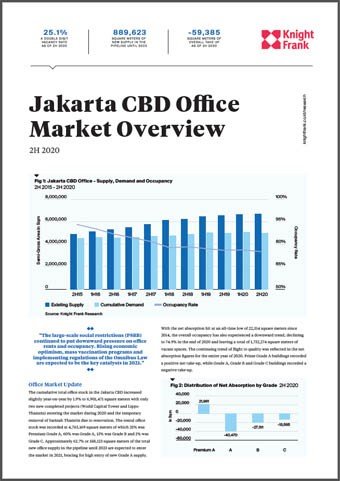

The cumulative total office stock in the Jakarta CBD increased slightly year-on-year by 1.9% to 6,901,471 square meters with only two new completed projects (World Capital Tower and Lippo Thamrin) entering the market during 2020 and the temporary removal of Sarinah Thamrin due to renovation. The rental office stock was recorded at 4,763,169 square meters of which 25% was Premium Grade A, 60% was Grade A, 13% was Grade B and 2% was Grade C. Approximately 62.7% or 558,123 square meters of the total new office supply in the pipeline until 2023 are expected to enter the market in 2021, bracing for high entry of new Grade A supply.

With the net absorption hit at an all-time low of 22,314 square meters since 2014, the overall occupancy has also experienced a downward tre nd, declining to 74.9% in the end of 2020 and leaving a total of 1,732,274 square meters of vacant spaces. The continuing trend of flight to quality was refl ected in the net absorption figures for the entire year of 2020. Prime Grade A bu ildings recorded a positive net take-up, while Grade A, Grade B and Grade C buil dings recorded a negative take-up.