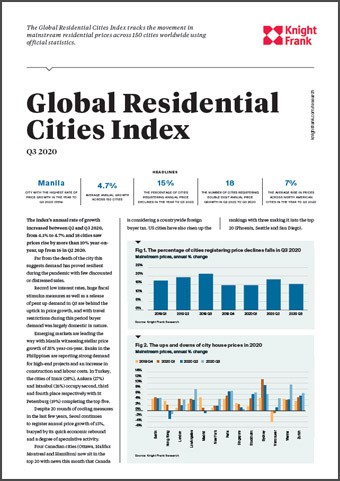

The Index’s annual rate of growth increased between Q2 and Q3 2020, from 4.1% to 4.7% and 18 cities saw prices rise by more than 10% year-onyear, up from 16 in Q2 2020.

Far from the death of the city this suggests demand has proved resilient during the pandemic with few discounted or distressed sales.

Record low interest rates, huge fiscal stimulus measures as well as a release of pent up demand in Q3 are behind the uptick in price growth, and with travel restrictions during this period buyer demand was largely domestic in nature.

Emerging markets are leading the way with Manila witnessing stellar price growth of 35% year-on-year. Banks in the Philippines are reporting strong demand for high-end projects and an increase in construction and labour costs. In Turkey, the cities of Izmir (28%), Ankara (27%) and Istanbul (26%) occupy second, third and fourth place respectively with St Petersburg (19%) completing the top five.

Despite 20 rounds of cooling measures in the last few years, Seoul continues to register annual price growth of 15%, buoyed by its quick economic rebound and a degree of speculative activity.